Released May 6, 2020 v1.5

There were (17) closings in Apr 2020 in Aspen, Brush Creek Village, Woody Creek, Snowmass Village and Old Snowmass – (15) of these went under contract prior to Mar 9th when Covid-19 related events changed reality in the US as we have known it.

April 2020 Bottom Line as of 05.06.20:

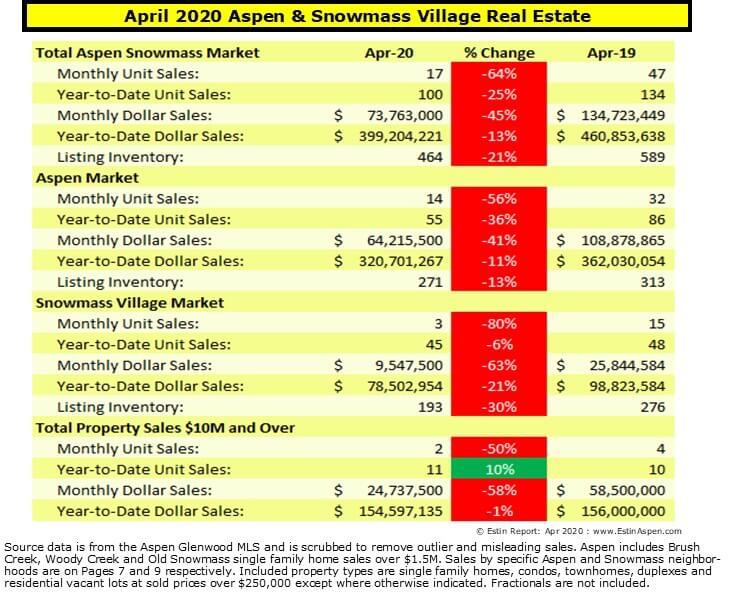

- For the Total Aspen & SMV Combined Market YTD, dollar sales are down 13% and unit sales are off 25%.

– Aspen solds in Apr ‘20 are off 56%, 14 now vs 32 last year.

– Snowmass Village (SMV) solds in Apr ‘20 are off 80%, 3 now vs 15 last year. - Between Feb 1 — Apr 30, 20:

– About 50% of Aspen under contracts about have fallen out and 38% of SMV UC’s have fallen out.

See specific April 2020 Covid 19 Effect Aspen and Covid 19 Effect Snowmass Village addendum charts and tables compared to same time last year.

The significant under contract and fall through of contracts – about 50% are failing – are not necessarily evidence that Aspen has slammed on the brakes anticipating some sort of crash.

There is a sense of cautious optimism that, at least for now, sale prices have held fairly steady. That means that while both buyers and sellers may be holding off because of health risks or economic uncertainty, there isn’t a panic-induced rush to offload property at a lower price point. But it simply may also be too soon to tell.

At least 25% of the Aspen market is Texas based and the oil and gas industry has been crushed. There are predictions we will see fall-out from this this summer. But it has not happened yet.

Right now, the sense is that we are dealing with something temporary, hitting the pause button and intend to resume as the economy recovers.

The question of course, becomes, whether the steady prices at the moment will hold.

Inventory levels, properties for sale, have been declining steadily for the past 2-3 years. We are presently at the lowest levels in over a decade. This puts pressure on prices to remain high or even perhaps go higher.

A Zillow analysis forecasts a 2 to 3 percent drop in home prices through the end of 2020 nationwide. Most Aspen buyers in the past year have been getting 3-10%, average 6-7%, off ask prices.

In Aspen/Snowmass, for properties presently under contract, there’s been anecdotal evidence that buyers are trying to negotiate incremental additional savings prior to their earnest money becoming non-negotiable, going hard.

Those involved in real estate in Aspen/Snowmass are holding out hope that this area’s relative remoteness, natural beauty, sophisticated infrastructure and amenities will create a new-found interest as a full-time residential alternative. In coastal areas, especially in NYC, rentals for 2nd homes and summer use have seen surging demand as have inquiries into homes for sale in vacation areas.

Buyers are still out there, they may just be waiting to see what homes will be listed in late May and June for the summer season while sellers hold off on listing houses until they are less nervous about having strangers in their home.

______________

For the March 2020 Snapshot, I wrote, “In the present Covid 19 shut down of all non-essential Aspen and Snowmass businesses, the following table and chart series document the radical change in market activity during March 2020 – fall throughs (deals that didn’t close), under contracts and solds in Feb and Mar 2020 vs 2019 year over year (YOY). We’ve yet to see the slowdown’s effect on actual sales as there is generally a 30-60 day lag time from under contract to closing.”

April 2020 Market Statistics Summary for Aspen Only *

Aspen condo sales April 2020

- Unit Sales: -71% (7) in Apr ‘20 from (24) in Apr ‘19

- Dollar Sales: -60% $16M in Apr ‘20 from $41M in Apr ‘19

- Inventory Active Listings: -4% (111) in Apr ‘20 from (116) in Apr ‘19

Aspen condo sales YTD

- Unit Sales: -41% (32) in Apr ‘20 from (54) in Apr ‘19

- Dollar Sales: +24% $147M in Apr ‘20 from $119M in Apr ‘19

- Inventory Active Listings: -17% (147) in Apr ‘20 from (179) in Apr ‘19

Aspen Single family home sales April 2020

- Unit Sales: +75% (7) in Apr ‘20 from (4) in Apr ‘19

- Dollar Sales: +26% $48M in Apr ‘20 from $38M in Apr ‘19

- Inventory Active Listings: -20% (126) in Apr ‘20 from (158) in Apr ‘19

Aspen Single family home sales YTD

- Unit Sales: -13% (20) in Apr ‘20 from (23) in Apr ‘19

- Dollar Sales: -8% $169M in Apr ‘20 from $184M in Apr ‘19

- Inventory Active Listings: -10% (174) in Apr ‘20 from (190) in Apr ‘19

April 2020 Market Statistics Summary for Snowmass Village Only

Snowmass Village condo sales April 2020

- Unit Sales: -90% (1) in Apr ‘20 from (10) in Apr ‘19

- Dollar Sales: -94% $.6M in Apr ‘20 from $10M in Apr ‘19

- Inventory Active Listings: -29% (124) in Apr ‘20 from (175) in Apr ‘19

Snowmass Village condo sales YTD

- Unit Sales: +11% (39) in Apr ‘20 from (35) in Apr ‘19

- Dollar Sales: +51% $57M in Apr ‘20 from $38M in Apr ‘19

- Inventory Active Listings: -29% (169) in Apr ‘20 from (236) in Apr ‘19

Snowmass Village Single family home sales April 2020

- Unit Sales: -75% (1) in Apr ‘20 from (4) in Apr ‘19

- Dollar Sales: -74% $4M in Apr ‘20 from $15M in Apr ‘19

- Inventory Active Listings: -28% (63) in Apr ‘20 from (87) in Apr ‘19

Snowmass Village Single family home sales YTD

- Unit Sales: -55% (5) in Apr ‘20 from (11) in Apr ‘19

- Dollar Sales: -72% $17M in Apr ‘20 from $59M in Apr ‘19

- Inventory Active Listings: -25% (78) in Apr ‘20 from (105) in Apr ‘19

* Typically, the Snowmass Village market represents 25-30% of the total combined Aspen Snowmass Village real estate marketplace.

Links to Apr 2020 Aspen and Snowmass Village Sold Property Photos and Details

Aspen Apr 2020 Closed Properties (13). This link is valid until 5/31/2020.

Snowmass Village Apr 2020 Closed Properties (2). This link is valid until 5/31/2020.

Vacant Lots Apr 2020 Closed Properties (1). This link is valid until 5/31/2020.