Miscellaneous quick Aspen real estate reference links:

Why Choose Aspen Real Estate Sotheby’s Broker Tim Estin to Sell Your Property?

TIM ESTIN’S PROPERTY LISTINGS – CUSTOM BROCHURES:

– CURRENTLY FOR SALE (SPRING 2024) US FOREST SERVICE IN-HOLDING – SURROUNDED BY 1,000’s OF ACRES OF US FOREST AND WILDERNESS LANDS, HALFWAY BETWEEN ASPEN & VAIL

– JB DOUBLE BAR RANCH – 406 ACRES ON REUDI RESERVOIR (REDUCED)

– NORTH STAR POINT – FACING NORTHSTAR PRESERVE, EAST ASPEN

– OLD WEST COMPOUND – WOODY CREEK

On Fri Feb 25, 22, Aspen Times columnist Roger Marolt wrote a beautiful piece on remembering Aspenite Jack Brendlinger and an Aspen past so wonderful from what we seem to be becoming in these pandemic times. Link to article.

PITKIN COUNTY GROWTH & LAND USE CODE ISSUES PRESENTLY UNDER DISCUSSION, NOV 2023

CITY OF ASPEN: FALL 2022 SIGNIFICANT CHANGES IN THE LAND USE CODE

Read highlights of these changes by Aspen’s Garfield & Hecht Law Firm

Aspen City Council considers City demo permits & special waivers, May 16, 24

PITKIN COUNTY LAND USE CODE – LUC – PRIMER 101 – Start video at 10:44

ZONING – LAND USE

Sec 4-20 Permitted Uses (Pgs 1-105), or shortcut link to pages 5-12 PERMITTED USE TABLE AND KEY (Pg 8)

Web-friendly shortcut Links to Pitkin County & City of Aspen Land Use Code

Zone Districts: All Zone Districts, AR2, R6, R15, R15A, R30, AR10

PITKIN COUNTY LAND USE CODE (LUC) CHAPTER 5 – DIMENSIONAL REQUIREMENTS (July 2006 Page 23)

CHEAT SHEET FOR CALCULATING ALLOWABLE FLOOR AREA (FAR)

RESTORATION HARDWARE (RH) – ASPEN ECOSYSTEM: “In January 2021, local Aspen developer Mark Hunt and RH, formerly known as Restoration Hardware revealed their collaboration to create a luxury boutique hotel, a show gallery, and additional retail, dining, and residential properties, collectively termed the ‘Aspen Ecosystem.’ According to the announcement, the RH Guesthouse at the Historic Crystal Palace was expected to open in 2022. “It’s going slower than we anticipated,” said RH Chairman and CEO Gary Friedman during the company’s 1st Qtr Report on 6/13/24. “Our development partner likes to say, ‘probably easier to develop on the moon than it is in Aspen,’ and things are taking more time. Aspen, it’s a small town.” Aspen Daily News

CITY OF ASPEN SHORT TERM RENTALS (STRs) REGULATIONS (New regs Oct 2022; updated May 1, 2023 – Ordinance 9)

Aspen CO STR Short Term Rental Map link & Resources for Property Owners

Snowmass Village, CO STR Short Term Rental Regulations and Resources for Property Owners

Article: Recent Aspen STRs short-term-rental regs diminish supply & dampen future growth, Apr 29, 23, Aspen Journalism

Definitions:

– Short term rental, STR = less than 30 days

– Long term rental, LTR = 30 days or more

Short Term Rental Tax Rates City of Aspen (Effective 01/01/2026):

– STR-C – STR-Classic, which include most more condominiums and homes, the new combined tax rate will be 22.35%, (formerly 21.3%).

– STR-OO – STR-Lodging Exempt and STR-Owner Occupied properties tax rate. The new combined tax rate will be 17.35%, (formerly 16.3%).

– STR-LE – Hotels and fractional properties pay the commercial lodging rate. The new combined tax rate will be 17.35%, (formerly 11.3%).

PITKIN COUNTY SHORT TERM RENTAL (STRS) REGULATIONS AND CODE

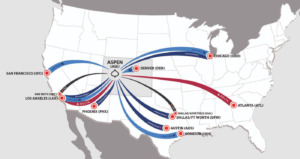

ASE: ASPEN/PITKIN COUNTY AIRPORT & GROUND TRANSPORTATION

Getting to Aspen Snowmass – Resources by Air and Ground

AIRLINES PARTNERS AS OF MARCH 2025 • American Airlines • Delta • United TOP FEEDER MARKETS • Atlanta, GA • Austin, TX • Chicago, IL • Dallas, TX • Denver, CO • Houston, TX • Los Angeles, CA • Orange County, CA • Phoenix, AZ • San Francisco, CA

PITKIN COUNTY PROPERTY VALUATIONS MAY 2023 ARTICLES

Property values soar and what it means for your Aspen Snowmass Pitkin County taxes, ADN 05/02/23

How to Read Your Pitkin County Valuation Notices, AT 05/04/23

State & local restrictions will limit Pitkin County property taxes, AT 04/06/23

PITKIN COUNTY PROPERTY TAXES – ASSESSOR & TREASURER

Pitkin County has the second-lowest mill levy in the state and Colorado has the third-lowest property tax burden in the country.

(Source: Pitkin County Commissioners Greg Poschman and Kelly McNicholas Kury op-ed 11/01/24 Aspen Daily News).

Real Estate Taxes in Pitkin County, CO – Aspen Real Estate – Explained: Colorado requires county assessors to perform a reappraisal of property – new valuations – every two years on the odd year. The next reappraisal will be in the spring of 2023 and will reflect the property value as of June 30, 2022. Taxes are paid in arrears. (The 2023 property tax bill will be for 2022 taxes due). The actual value of a property is determined by the county assessor’s office. The assessment rate is set by the state. In 2023, the Colorado legislature lowered the residential and multi-family property rate to 6.765% from 6.95% earlier in the year. Mill levies are set by local special tax districts and will not be finalized until sometime in December (typically, after the Nov. elections)…Pitkin County property tax collections are restricted (for the most part) to a limit of 5.5% increase per Tabor amendment. (Nov 4, 23 Aspen Times)

Pitkin Co officials say limits will keep taxes from rising like home prices (April 7, 23 Aspen Times)

Pitkin County Real Estate Taxes on Vacant Land versus a Lot with Home or Legal Structure

ASPEN TAX DISTRICTS FOR REAL ESTATE TRANSFER TAX (RETT) – BUYER PAYS UPON CLOSING – The City of Aspen and the Town of Snowmass Village collect a Real Estate Transfer Tax (RETT) on property conveyances within their boundaries. Within the City of Aspen, the RETT is 1.5% of the property purchase price; in the Town of Snowmass Village, it is 1.0%. The tax is payable by the buyer for property within these listed areas.

ASPEN NEIGHBORHOODS WHERE RETT APPLIES AT 1.5% OF PURCHASE PRICE

ASPEN’S LIFT 1A CORRIDOR DEVELOPMENT PLANS – GORSUCH HAUS/AMAN RESORTS & LIFT ONE LODGE (as of Aug 2025)

CHEAT SHEET v4 LINKS & ARTICLES (Updated Aug 2025)

LIFT 1A CORRIDOR PLAN ILLUSTRATION, PLANS W/OPEN SPACE

GORSUCH HAUS/AMAN RESORTS – condensed land use application.

LIFT ONE LODGE – condensed land use application.

ASPEN IDEAS – A DESCRIPTION – Article: “The Aspen Idea describes the integration of body/mind/spirit – the nurturing of the whole person – and it came to the fore in the earliest days of the Aspen Institute where artists, leaders, thinkers, and musicians could gather…Mortimer Adler once referred to Aspen as the “Athens of the West.” And upon his visit here in 1949, Albert Schweitzer’s proclaimed “Aspen is a little too close to heaven.”

2014 – 2022 Flip Job Examples – Recent or In-Process Redeveloped Properties

-Nationally:

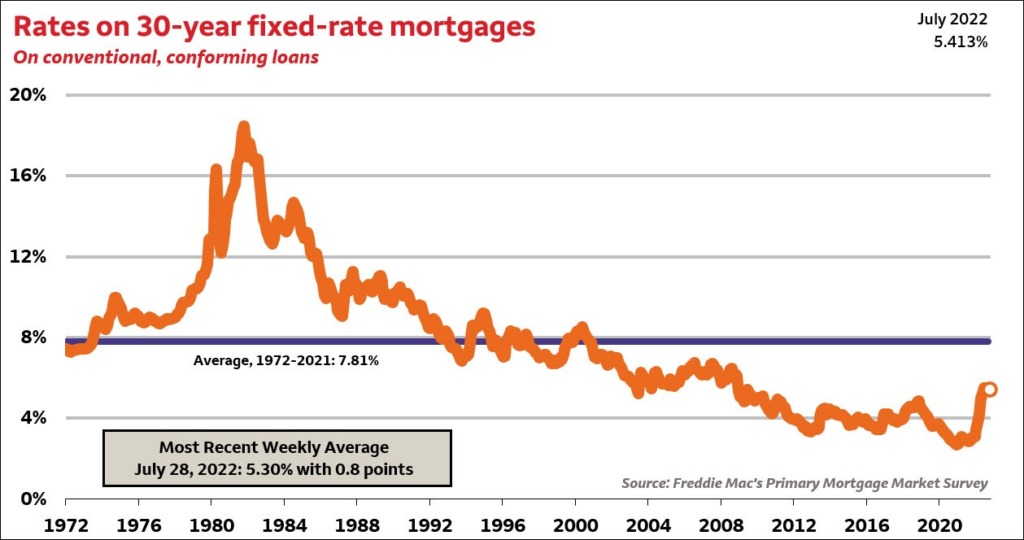

–Pitkin County Mortgage Rates – Wells Fargo

FENCING REGS REGULATIONS IN CITY OF ASPEN CO

2019 Best Aspen Restaurants Cheat Sheet List

Rental Program Ratings Description courtesy Frias Property Management

RH – The Man Behind the Curtain NYT May 8, 24

Restoration Hardware RH Guesthouse 2022-2023 Plans for Aspen

Residences at The Little Nell (RLN Aspen) – Buyers’ Info and FAQ’S

Downtown Aspen Penthouses approved and in development pipeline as of Mar 2019

Aspen Highlands Residential Metropolitan Tax District Info

Brush Creek Metro District & contacts: Brush Creek Landowners Association (BCLA) is Evie at Marolt, LLC 970‐925‐4047 Ext 5. (Oct 2019)

Pitkin County Board Approves Solar Farm, Nov 18, 2019, Aspen Times

Dial-a-Ride info – Dial-a-Ride serves the Mountain Valley residential area on a fixed route free of charge. Provides door-to-door service in this area for $1. Call 970.920.9999 to schedule personalized service. Dial-A-Ride service is available: 6:30 a.m. – 1:45 a.m. daily

RFTA – City of Aspen – Bus Ride Route Maps & Schedule – 970.925.8484

RADON INFORMATION

About Radon and Radon Mitigation Info in Aspen and Snowmass – Newspaper Insert

High radon levels detected in half of Aspen’s locally tested homes, Article, Jan 3, 2020 ADN

SMUGGLER SUPERFUND SITE ASPEN Superfund Site Aspen

City of Aspen: Smuggler-Superfund-Site

Pitkin County: Smuggler-Superfund-Site

Aspen Times: Smuggler officially off superfund list

Map view: Smuggler superfund site

11.25.91 New Yorker: Report from Aspen – superfund site

Smuggler Mobile Home Park

ZIPCODES ASPEN TO GLENWOOD SPRINGS – ROARING FOR VALLEY – Zip Code PDF

Aspen Historic Victorian and Aspen Modern Preservation Resources

Aspen Modern – a guide to mid-20th century architecture in Aspen in which certain desIgnated properties fall under the auspices of the Aspen Historical Preservation Commission.

12.20.22 ADN The Price of County TDRs Keeps Rising

12.10.21 AT Price of Pitkin Co TDRs Hits $1.8M

03.21.21 ADN: Transferable development rights, or TDR’s in the real estate industry, proved attractive to property owners during the COVID-19 pandemic especially, Aspen appraiser Randy Gold continued, “A TDR in Pitkin County equates to 2,500 square feet of buildable area,” he explained, adding that the program was started in 1995 and TDR prices sold on the open market were generally stable “for years and years,” at between $200,000 and $250,000 for most of that time period. “In July 2020, TDRS were selling for $230,000. By the end of the year, the most recent closing on TDRs were selling for $360,000,” he said. “And now, Feb 2021, there are TDRS under contract for $375,000 to $400,000.”

City of Aspen TDR Request by Homeowner Denied, AT

USFS Forest Service Flexible Partnerships Act of 2017

219 N. Monarch Redeveloped Aspen Home in Aspen’s West End Land Planner Analysis

Ag Status: Pitkin County Assessor – Agricultural Property Designation

Ag Status: Eagle County Assessor – Ag Agricultural Property Questionaire and Valuation Information

APCHA RESIDENT OCCUPIED (RO) LOCATIONS LIST & PET INFO

LOCAL HIGHWAY MILE MARKERS: INTERSTATE 70 AND HIGHWAY 82