Released April 12, 2018 v.2.25 (Pg 3 and Pg 7 condo footnotes were updated to reflect specific avg. condo prices per sq ft)

Yodel from the Mountains! Estin Report: March 2018 Aspen Snowmass Real Estate Market

The Estin Report: Mar 2018 Aspen Snowmass Real Estate Market Snapshot is a 10-Page statistical breakdown of monthly and year-to-date sales in detail. The Monthly Snapshots are posted on or near the 1st Monday of the month. It is the only monthly Aspen market report to be published in a consistent and timely manner.

The 1st Quarter of the year is typically the slowest of the year, and March 2018 contributed to that significantly. While Jan and Feb were very active, March sales ran out of gas.

The lack of snow locally, the multiple big storms in the east and resulting vacation cancellations seems to be the obvious reason for the March slowdown. Stock market volatility may be another.

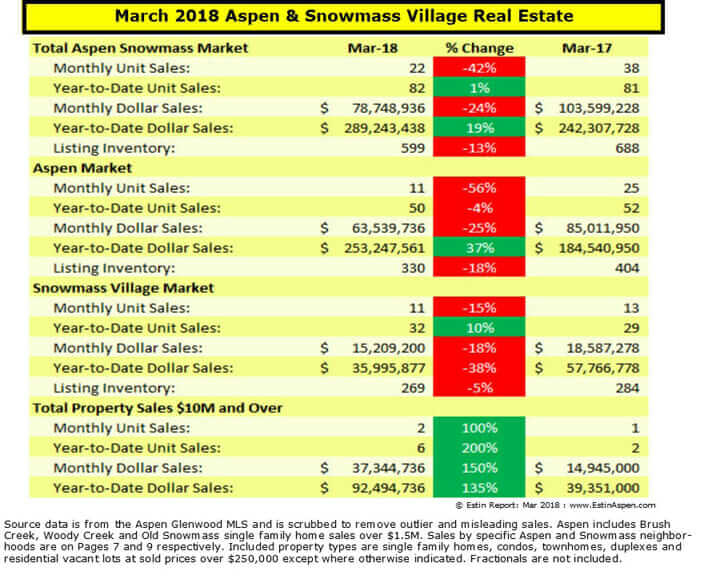

In March 2018, Aspen only unit sales fell 56% to 11 sales for the month versus 25 last Mar 2017; dollar sales fell 25% to $64M from $85M during the same period. Snowmass sales also were down but less than Aspen as March is prime time selling season for Snowmass Village. Aspen sales are less seasonal than Snowmass’.

For the year to date through Mar 2018, total Aspen and Snowmass combined dollar sales are ahead of last year by 19%, $289M now vs $242M last year, and total combined unit sales are up 1%, 82 sales this year vs 81 last year.

A big reason for the sizable lead in dollar volume is that sales of homes over $10M are up 200% over same time last year, 6 sales through March this year versus 2 last year and up 136% in these dollar sales, $92M vs $39M last year.

The Aspen condo market, in general, has been very strong in the past year. But poor snow conditions, the lack of quality condo selection and higher prices may explain why condos unit sales were off 54% in Mar 2018, 12 sales versus 26 last year.

Condo unit sales year-to-date (YTD) through March are about even with same time last year, 52 sales now versus 50 sales then. Condo dollar sales YTD are ahead 39%, $123M to $89M reflecting larger-sized and more expensive units selling.

Inventory of active condo listings has fallen 30% and buyer selection is thinning. Remodeled, like-new units are being snapped up quickly at ever higher prices.

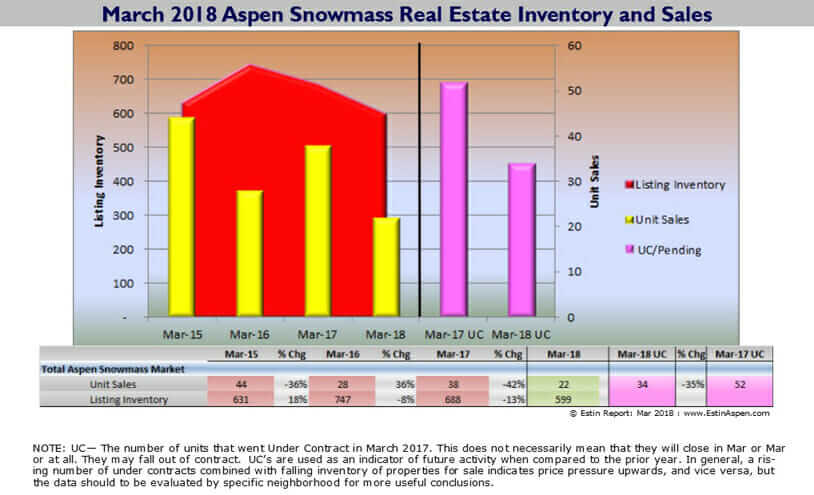

As an indicator of future activity, the number of under contracts in March 2018 was down 35% to 34 UC’s versus 52 same time last year. These are for deals scheduled to close in April and May.

Click image to enlarge.

Link to full 10-Page Mar 2018 Aspen and Snowmass

Real Estate Market Snapshot

Click image to enlarge.

Deep Dive: Sales by Neighborhoods

Aspen Neighborhood Sales Pg 7 Snowmass Village Neighborhood Sales Pg 9

March 2018 Market Statistics Summary for Aspen Only *

Aspen condo sales March 2018

- Unit Sales: -67% (5) in March ‘18 from (15) in March ‘17

- Dollar Sales: -21% $24M in March ‘18 from $31M in March ‘17

- Inventory Active Listings: -30% (124) in March ‘18 from (178) in March ‘17

Aspen condo sales YTD

- Unit Sales: -30% (30) in March ‘18 from (29) in March ‘17

- Dollar Sales: +67% $111M in March ‘18 from $66M in March ‘17

- Inventory Active Listings: -30% (124) in March ‘18 from (178) in March ‘17

Aspen Single family home sales March 2018

- Unit Sales: -44% (5) in March ‘18 from (9) in March ‘17

- Dollar Sales: -23% $37M in March ‘18 from $48M in March ‘17

- Inventory Active Listings: -9% (156) in March ‘18 from (172) in March ‘17

Aspen Single family home sales YTD

- Unit Sales: 0% (17) in March ‘18 from (17) in March ‘17

- Dollar Sales: 29% $129M in March ‘18 from $100M in March ‘17

- Inventory Active Listings: -9% (156) in March ‘18 from (172) in March ‘17

* Typically, the Aspen market represents 70-75% of the total combined Aspen Snowmass Village real estate marketplace.

Links to March 2018 Aspen and Snowmass Village Sold Property Photos and Details

Aspen Mar 2018 Closed Properties (10). This link is valid until 5/1/2018.

Snowmass Village Mar 2018 Closed Properties (11). This link is valid until 5/1/2018.

Vacant Lots Mar 2018 Closed Properties (1). This link is valid until 5/1/2018.

__________________________________________