Released 12.06.20 v1.6.

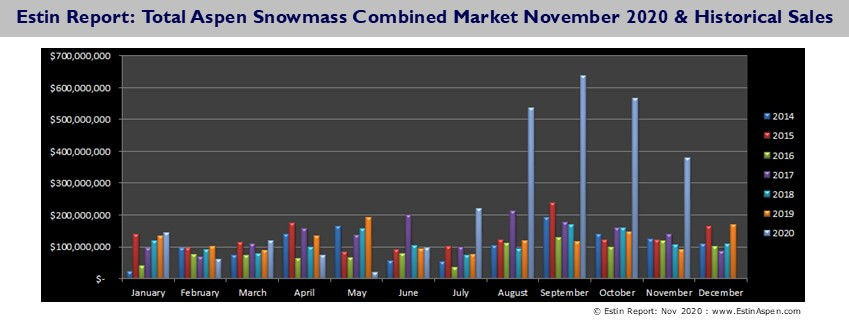

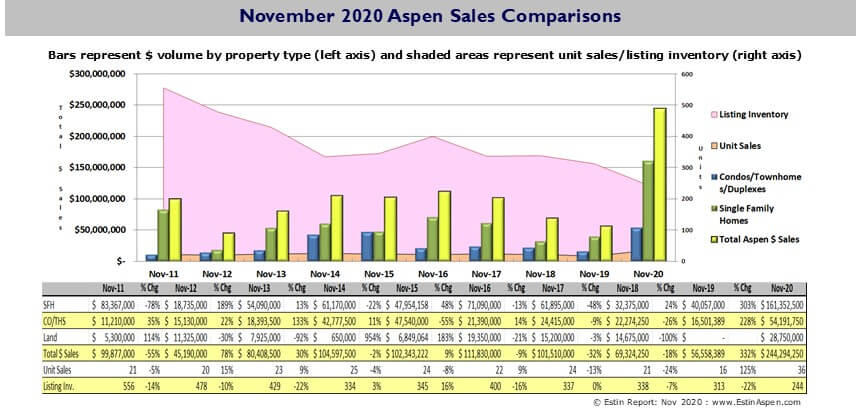

BOTTOM LINE While Aspen real estate market activity slowed somewhat in Nov 2020, dollar and unit sales records continue to be broken. Although we are in the off-season, a period when activity always declines, anecdotally, it feels like buyers are stepping back, retreating into the safety of their primary homes while the 2nd wave of massive Covid 19 outbreaks immobilizes the nation with fear and uncertainty, and we wait for vaccinations.

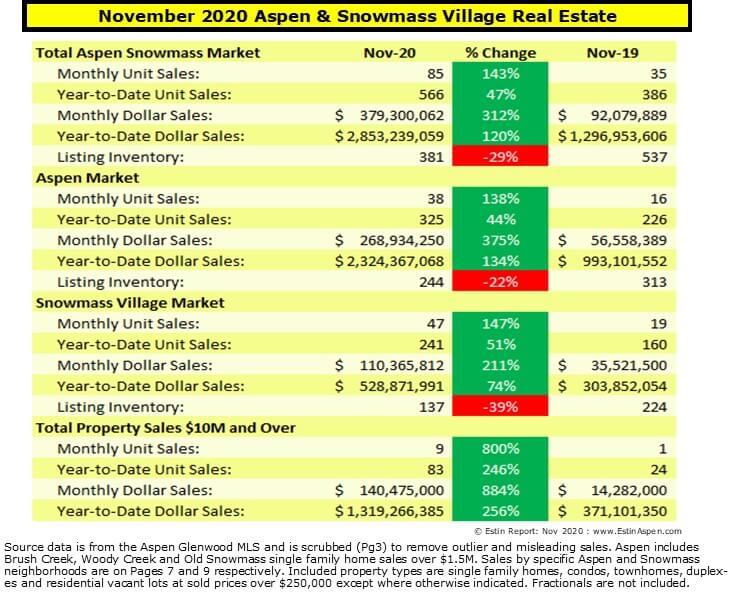

While the entire valley-wide real estate market is on fire with properties of all types and price points selling briskly, the most spectacular Aspen real estate market event has been the predominance off individual property sales over $10M. The number of individual unit sales over $10M YTD is almost 4X more than the same time last year and dollar sales are 3 1/2X more. These numbers are mind-blowing.

Overall, for property types of all kinds, inventory levels of properties for sale in Aspen are at their lowest point since 2005. (See charts on 12/07/20 blog post going back to 2005.)

For more context, inventory is 30% lower than 2015 and 2017, the peak performing years prior to this year’s unmatched record-setting.

Some buyers are stepping back, hesitating on pulling the trigger in what they see as a Covid induced mania in addition to not finding quality properties within their price range. For some, they are ecstatic closing on an Aspen property, for others it’s been frustrating as the market moves upward into a higher price range and choices diminish.

Prices will go up with high demand and low supply. This has been occurring for the past 3-5 months as new listings come onto the market at an average asking price increase of 15-30%. However, there are exceptions – specific instances by location and/or property type where price acceleration is not happening. Contemporary new homes are breaking price records; the older the home and/or less ‘modern’ architecturally, the less – if any – the price appreciation. Other examples: older homes in Starwood selling at more or less unchanged land value; Brush Creek Village subdivision land values are unchanged; land values in the Mountain Valley subdivision in east Aspen have barely moved. And there are more pockets of price resistance throughout Aspen and Snowmass. Each neighborhood is its own micro-market and requires deeper investigation.

Snowmass Village (SMV) inventory of properties for sale has been fairly consistent throughout the years with the exception of new large scale condo developments coming on line such as The Viceroy Hotel Condos (2008/2009), The Limelight (2018/2019) and Base Village projects (2019/2020) – all of which significantly filled the market. Higher prices for this new product drove average prices upwards, but older, particularly non-remodeled condos suffered in the shadow of “newness” becoming the ”deals”.

The hyper Aspen market this year is pushing frustrated Aspen buyers towards less expensive Snowmass which has been selling at 40-50% discount to Aspen prices for the past 3-5 years but that gap is tightening. SMV inventory is down approximately 40-45% since July/Aug from average inventory levels.

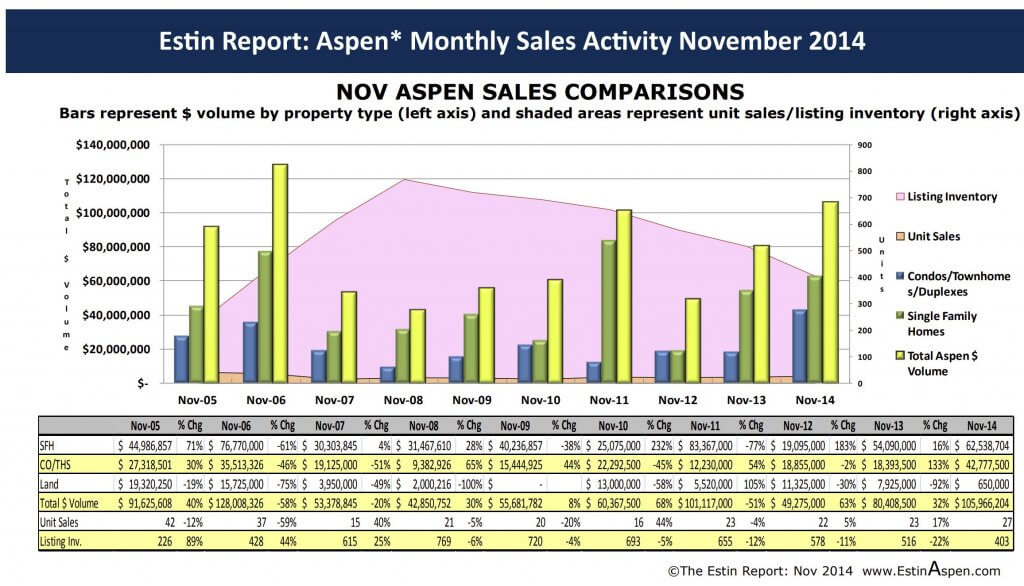

Please take note that the numbers above comparing Nov 2020 to Nov 2014 do not completely align. Main Reason (95%): back then I included inventory for Old Snowmass (OSM) and Woody Creek (WC) in the Aspen Inventory. At some point over the last 6 years (I do not recall when at present) I decided not to include those inventory numbers within ‘Aspen’ because properties were not selling in OSM and WC and they were disproportionately affecting Aspen inventory levels, making it look higher than it actually was. Secondary Reason (5%): The inventory numbers will change slightly month to month….its trailing information. (Typically, I pull the numbers on the 2nd or 3rd of the month – a point in time – but data gets updated continuously in the MLS afterwards and the numbers can change.)

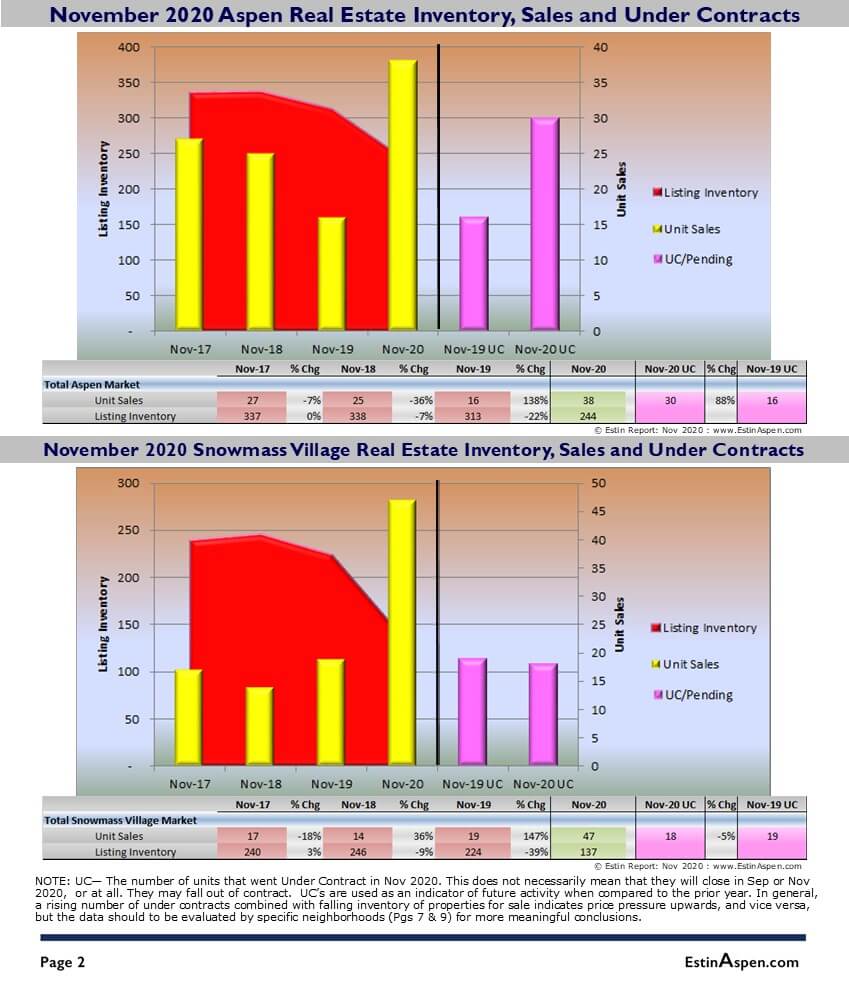

Aspen Only: November 2020 Market Statistics Summary

Aspen condo sales November 2020

- Unit Sales: +90% (19) in Nov ‘20 from (10) in Nov ‘19

- Dollar Sales: +313% $68M in Nov ‘20 from $17M in Nov ‘19

- Inventory Active Listings: +4% (115) in Nov ‘20 from (111) in Nov ‘19

Aspen condo sales YTD

- Unit Sales: +26% (158) in Nov ‘20 from (125) in Nov ‘19

- Dollar Sales: +126% $612M in Nov ‘20 from $271M in Nov ‘19

- Inventory Active Listings: +22% (350) in Nov ‘20 from (285) in Nov ‘19

Aspen Single family home sales November 2020

- Unit Sales: +150% (15) in Nov ‘20 from (6) in Nov ‘19

- Dollar Sales: +99% $172M in Nov ‘20 from $40M in Nov ‘19

- Inventory Active Listings: -28% (113) in Nov ‘20 from (156) in Nov ‘19

Aspen Single family home sales YTD

- Unit Sales: +99% (151) in Nov ‘20 from (76) in Nov ‘19

- Dollar Sales: +165% $1,613M in Nov ‘20 from $608M in Nov ‘19

- Inventory Active Listings: +16% (354) in Nov ‘20 from (303) in Nov ‘19

*Typically, the Aspen market represents 70-75% of the total combined Aspen Snowmass Village real estate marketplace.

Snowmass Village Only: November 2020 Market Statistics Summary

Snowmass Village condo sales November 2020

- Unit Sales: +106% (33) in Nov ‘20 from (16) in Nov ‘19

- Dollar Sales: +118% $47M in Nov ‘20 from $21M in Nov ‘19

- Inventory Active Listings: -34% (93) in Nov ‘20 from (141) in Nov ‘19

Snowmass Village condo sales YTD

- Unit Sales: +43% (166) in Nov ‘20 from (116) in Nov ‘19

- Dollar Sales: +89% $237M in Nov ‘20 from $125M in Nov ‘19

- Inventory Active Listings: +3% (340) in Nov ‘20 from (328) in Nov ‘19

Snowmass Village Single family home sales November 2020

- Unit Sales: +333% (13) in Nov ‘20 from (3) in Nov ‘19

- Dollar Sales: +343% $62M in Nov ‘20 from $14M in Nov ‘19

- Inventory Active Listings: -47% (40) in Nov ‘20 from (75) in Nov ‘19

Snowmass Village Single family home sales YTD

- Unit Sales: +71% (70) in Nov ‘20 from (41) in Nov ‘19

- Dollar Sales: +61% $282M in Nov ‘20 from $175M in Nov ‘19

- Inventory Active Listings: -9% (142) in Nov ‘20 from (157) in Nov ‘19

* Typically, the Snowmass Village market represents 25-30% of the total combined Aspen Snowmass Village real estate marketplace.

Links to Nov 2020 Aspen and Snowmass Village Sold Property Photos and Details

Aspen Nov 2020 Closed Properties. This link is valid until 12/31/2020.

Snowmass Village Nov 2020 Closed Properties. This link is valid until 12/31/2020.

Vacant Lots Nov 2020 Closed Properties. This link is valid until 12/31/2020.