released v9.4

Click image for executive summary and full report pdf in Current Reports section

Highlights

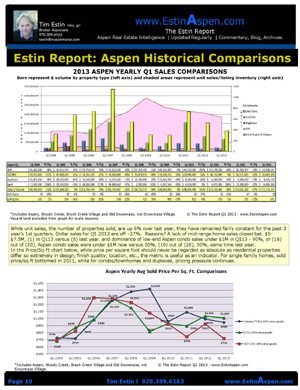

In the 1st Quarter 2013 (Jan. 1- Mar. 31), the number of units, or properties, sold was up 6% from the same time last year, 90 units this year versus 64 last year, and dollar sales were down 23% at $148M this year versus $191M last year.

A surge at the end of the year 2012 in big ticket $10M+ sales motivated by anticipated 2013 tax-changes seems to have taken the wind out of high-end Aspen dollar sales in the 1st Quarter 2013.

Instead, market activity has been dominated by smaller-sized and under $1M property sales and a flood of new Snowmass Base Village Viceroy condo sales selling at 60% off pre- recession prices since their sales program was re-activated Dec. 15, 12 after a 3-year market hiatus due to litigation issues and the recession.

Comparing the past three years 1st Quarters shows continued loss of dollar sales momentum from the recession high point in Q1 2011.

Yet, in light of the positive trending economic news throughout the country – a record level stock market, strong real estate performance on both coasts and especially in NYC and the Hamptons – it is a puzzle why the Aspen market has not performed better in Q1 2013.

Historically, the Aspen market has been last in, first out of recessions but presently, we appear to be trailing other high end markets.

The big difference between this quarter and the same period last year is the significant increase in lower end sales under $1M, the lack of big ticket (+$10M) sales and a gaping hole of inactivity in the $5-10M sales range.

The increase in lower end sales indicates a widening of Aspen’s real estate recovery base no longer limited to exclusively headline capturing high-end purchases. ”