Released 06/08/16 v2.75.

Click Table above to view full May 2016 Market Snapshot (10 Pgs)

May 2016 Bottom Line

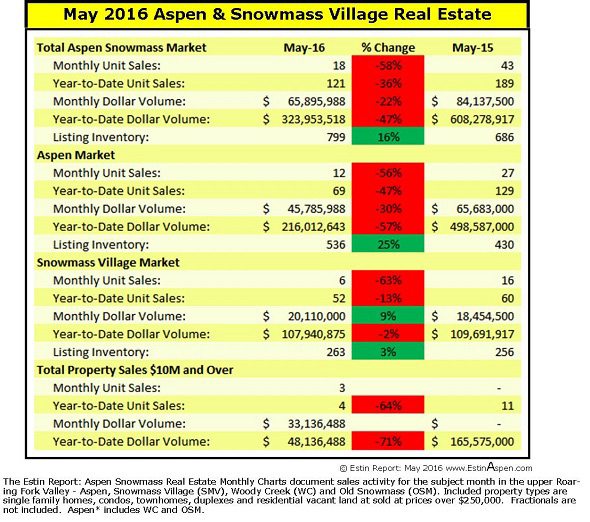

May 2016 YTD, Jan 1 – May 31, has been the 3rd worst performing period in the past 10 years. Only 2009 and 2010 were worse.The Aspen Snowmass market continued its downward fall in May 2016 over May 2015 and year-to-date (YTD). Aspen – and the high end in particular – has suffered much more than Snowmass Village which has been the ‘shining light’, in terms of at least moderate sales increases, in this puzzling story.

Depending on the metrics one looks at, the Aspen market is off by about 50% YTD through May 31, 2016 from last year.In some cases even more by a large margin.

Aspen’s most desirable locations, the West End and Red Mountain, have experienced little or no sales, and luxury sales of properties $10M and over, typically accounting for roughly 25-30% of total dollar sales, were 15% of the total market sales dollars in May 2016 YTD versus 27% in May 2015 YTD: $10M and over salesare down -64% in unit sales to (4) this year versus (11) last year and -71% in dollar sales to $48M in from $166M same time last year.

Snowmass Village sales (38% of the total combined market in May 2016 versus 18% in May 2015 YTD, and typically representing 25-30% of total combined market sales) fared better…likely because the discounted values remain with prices approximately 50% of Aspen prices.

So far, list prices remain largely unchanged even as the inventory of properties for sale generally increase: in May 2016, Aspen homes have risen 8% and condos 18%; SMV homes are down -16% as buyers seek values and condos are up 12%.

Savvy sellers might consider getting “ahead” of this dismal news and price with a “reality based” mentality; buyers may wish to consider the opportunity here to enter the Aspen market finding better values than last year.

The summer selling season will let us know.

May 2016 Market Snapshot Statistics Summary for Aspen Only*

Aspen condo sales May 2016

Unit Sales: -47% (8) in May ‘16 from (15) in May ‘15

Dollar Sales: -5% $21M in May ‘16 from $22M in May ‘15

Inventory Active Listings: +56% (220) in May ‘16 from (141) in May ‘15

Aspen condo sales YTD

Unit Sales: -35% (46) in May ‘16 YTD from (71) in May ‘15 YTD

Dollar Sales: -31% $105M in May ‘16 YTD from $153M in May ‘15 YTD

Inventory Active Listings: +18% (290) in May ‘16 YTD from (244) in May ‘15 YTD

Aspen Single family home sales May 2016

Unit Sales: -57% (3) in May ‘16 from (7) in May ‘15

Dollar Sales: -22% $23M in May ‘16 from $30M in May ‘15

Inventory Active Listings: +8% (231) in May ‘16 from (214) in May ‘15

Aspen Single family home sales YTD

Unit Sales: -56% (19) in May ‘16 YTD from (43) in May ‘15 YTD

Dollar Sales: -68% $90M in May ‘16 YTD from $285M in May ‘15 YTD

Inventory Active Listings: +8% (303) in May ‘16 YTD from (280) in May ‘15 YTD

* Typically, the Aspen market represents 70-75% of the total combined Aspen Snowmass Village real estate marketplace. In May 2016, Aspen property sales represented 62% of the total combined market versus 82% in May 2015.

Links to May 2016 Aspen and Snowmass Village Sold Property Photos and Details

Aspen May 2016 Closed Properties (12). This link is valid until 7/2/2016.

Snowmass Village May 2016 Closed Properties (6).This link is valid until 7/2/2016.

Vacant Lots May 2016 Closed Properties (1).This link is valid until 7/2/2016.

Disclaimer: The statements made in The Estin Report and on Aspen broker Tim Estin’s blog represent the opinions of the author and should not be relied upon exclusively to make real estate decisions. A potential buyer and/or seller is advised to make an independent investigation of the market and of each property before deciding to purchase or to sell. To the extent the statements made herein report facts or conclusions taken from other sources, the information is believed by the author to be reliable, however, the author makes no guarantee concerning the accuracy of the facts and conclusions reported herein. Information concerning particular real estate opportunities can be requested from Tim Estin at 970.309.6163 or by email. The Estin Report is copyrighted 2016 and all rights reserved. Use is permitted subject to the following attribution with a live link to the source: “The Estin Report on Aspen Real Estate.”

_______________________________________