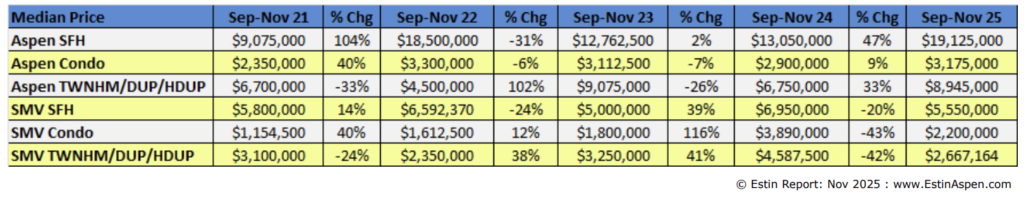

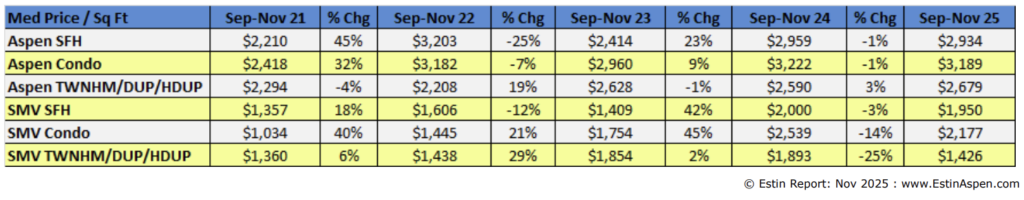

This is a year-end 2025 snapshot of Aspen and Snowmass Village residential real estate prepared just after Christmas, 12/27/25. The full 32-page 2025 year-end Estin Report will follow in early-mid January. References herein are made to the November 2025 Market Snapshot.

Nov 2025 Snapshot (Pg 4)

Bottom line: Aspen’s 2025 market is being led by the ultra high-end – $20M+ sales are no longer outliers — they are a defining feature of the luxury market.; Snowmass Village 2025 metrics are heavily influenced by the Base Village development cycle.

LINK TO 2025 YEAR END SUMMARY PDF