Released April 10, 2016 v2.1

Click image above for full March 2016 Snapshot

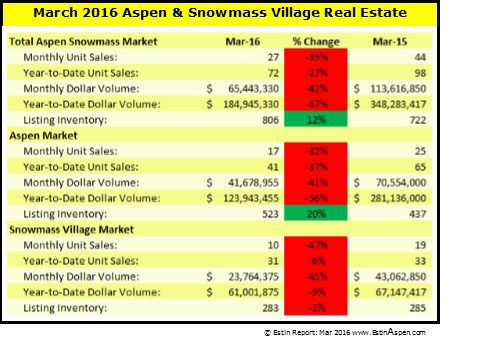

Bottom Line in the Snapshot: “The market continued to tank in March. Aspen, which accounts for approximately 70% of total Aspen Snowmass combined sales, was down particularly hard… Buyer demand is off sharply contrasting with a rising invent-tory of properties for sale at ever-higher ask prices. A disconnect to be sure. Luxury sales of properties over $10M (approx. 30% of all sales dollars in 2015) plummeted -86% from (7) in Q1 2015 to (1) in Q1 2016. The single over $10M sale in the quarter was for a 4 bdrm penthouse condo at Monarch on the Park in downtown Aspen selling for $15M at an all-time record setting $4,275 sq ft. Buyers are seeing greater negotiating spread, and, for those sitting on the sidelines, this may be an opportune entry period. In Q1 2016, the total market is off just –3% from same time in 2014 which turned out to be the best in the 5 preceding years as well as the conclusive recession turnaround year.”

…continued in this post:For the month, Aspen single family home sales are down -33%, from (6) sales in Mar 2015 to (4) in Mar 2016. For year to date, the 1st Quarter Aspen home sales were down -45% from (27) sales in Q1 2015 to (12) sales in Q1 2016. Aspen homes sold at 83% to ask price this past quarter versus 87% to ask a year ago. Listing inventory of homes for sale has increased 10% from (207) to (228).

Aspen condo sales were down -19% from (16) to (13) in Mar 2016 comparing year over year. For year to date, the 1st Quarter Aspen condo sales were down -23% from (35) sales in Q1 2015 to (27) sales in Q1 2016. Aspen condos sold at 97% to ask price this past quarter versus 93% to ask a year ago. Listing inventory of condos for sale has increased 19% from (204) to (242).

The listing inventory of properties for sale in the total Aspen market has increased 20% from (437) listings in Q1 2015 to (523) in Q1 2016.

New listings have come on the market at generally very aggressive prices meaning sellers still think the market’s hot when it clearly is not at present (although this downturn may/may not be temporary), or they’re thinking now may be a better time to sell than later in this uncertain environment. There’s a disconnect between sellers and buyers at present. Well priced and/or unique product continues to sell well.

Snowmass Village (SMV), the ski resort, was also down particularly hard. But whereas the Aspen specific market has surged upward in the past two years, SMV has been down now for 6 years and still crawling. For the month, SMV single family home sales are down -40%, from (3) sales in Mar 2015 to (2) in Mar 2016. SMV condo sales are down -63% from (16) to (6) in the same period. Listing inventory of homes for sale has decreased -11% from (71) then to (63) now.

The SMV numbers for the 1st Quarter 2016 are better than the March only figures. SMV single family home sales are up 50%, from (6) sales in Q1 2015 to (9) in Q1 2016. SMV condo sales are down -24% from (25) to (19) in the same period. The listing inventory of properties for sale in the total SMV market has fallen just -1% from (285) listings in Q1 2015 to (283) in Q1 2016.

On the positive side, buyers are seeing a greater negotiating spread, and for those sitting on the sidelines, this may be an opportune entry period.

What’s ahead?

The number of pending or under contract properties in Mar 2016 fell -15% from (47) in Mar 2015 to (28) in Mar 2016. Pending sales are considered a future indicator of activity as their closing usually take place 21 to 45 days later in our market.

Some big pocketed Aspen property investment groups are sitting on a lot of high priced inventory of homes, a number of them in the West End, that they are “flipping” as remodeled or like-new product. While some savvy buyers believe these guys are going to “blow up” as they are over invested and their ask prices are very high, others think these investors/redevelopers may just be successful because they’ve got the newest built product in town… and buyers want new, new, new. Their success remains to be seen, although it will only take just one or two of these sales at or near ask price to trigger a new round comparable sales at higher prices.

It is a fact that the Aspen real estate market mirrors the financial markets like never before.Financial news turned positive in mid to late Feb and the stock market is again approaching record territory in early April 2016. But lingering fears of something unforeseen keeps everyone looking over their shoulders. A measure of uncertainty prevails. This sentiment and market volatility seem like constants in the internet age.

Interest rates supposedly will rise imminently although we’ve been expecting this for the past two years. The good news is that we are still at historic lows.

Disclaimer: The statements made in The Estin Report and on Aspen broker Tim Estin’s blog represent the opinions of the author and should not be relied upon exclusively to make real estate decisions. A potential buyer and/or seller is advised to make an independent investigation of the market and of each property before deciding to purchase or to sell. To the extent the statements made herein report facts or conclusions taken from other sources, the information is believed by the author to be reliable, however, the author makes no guarantee concerning the accuracy of the facts and conclusions reported herein. Information concerning particular real estate opportunities can be requested from Tim Estin at970.309.6163or byemail.The Estin Report is copyrighted 2016 and all rights reserved. Use is permitted subject to the following attribution with a live link to the source:“The Estin Reporton Aspen Real Estate.”

_______________________________________