This is a year-end 2025 snapshot of Aspen and Snowmass Village residential real estate prepared just after Christmas. The full 32-page 2025 year-end Estin Report and Dec 2025 Snapshot will follow in January. References herein are made to the November 2025 Market Snapshot.

Nov 2025 Snapshot (Pg 4)

Bottom line: Aspen’s 2025 market is being led by the ultra high-end – $20M+ sales are no longer outliers — they are a defining feature of the luxury market; Snowmass Village 2025 metrics are heavily influenced by the Base Village development cycle.

Aspen: ultra-luxury is now a normalized market segment

For clarity, “luxury” Aspen sales are those above $10M (with $15M–$20M arguably the more relevant threshold), and “ultra-luxury” is above $20M. That definition continues to shift upward as the market evolves.

In 2025, the $20M+ segment expanded materially, up roughly 160% versus 2024 in unit sales.

$20M+ share of $10M+ sales

- 2025 YTD (through 12/20/25): 34 sales above $20M out of 100 sales above $10M (34% of units). $20M+ dollar volume totaled $1.145B, representing 56% of total $10M+ dollar volume ($2.050B).

- 2024: 13 sales above $20M out of 95 sales above $10M (14% of units). $20M+ dollar volume totaled $642.7M, representing 32% of total $10M+ dollar volume ($2.026B).

Aspen YTD (through Nov 2025) – Residential

- Total Dollar sales: $2.16B vs $1.70B prior year (+29%)

- Total Unit sales: 171 vs 163 prior year (+5%)

(Includes on- and off-market sales.)

Inventory (Nov 2025)

- 163 active listings vs 178 prior year (-8%)

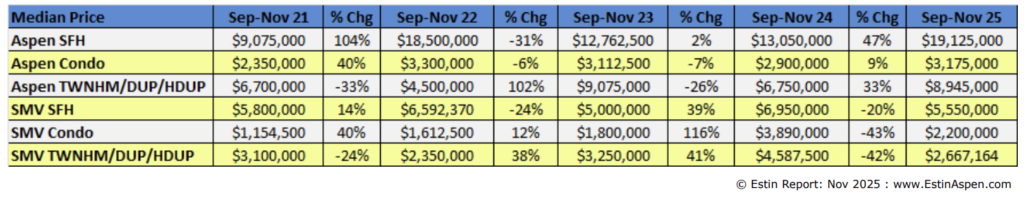

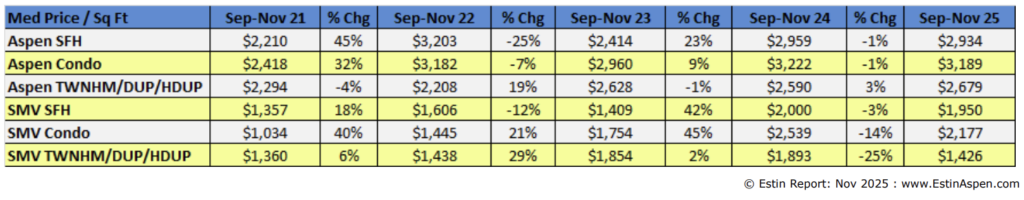

Pricing (Sep–Nov, last 3 months)

- Single-family homes: median sale price $19.125M (vs $13.7625M prior year); median $/sf flat ($2,934 vs $2,959)

- Condos: median sale price $3.175M (vs $2.9M prior year); median $/sf flat ($3,189 vs $3,222)

Aspen continues to be viewed globally as a uniquely beautiful mountain town with authentic historic roots and a modern, world-class mix of sport, art, and culture:

Unmatched. Unrivaled. Unparalleled.

In a market defined by scarcity, the question buyers repeatedly ask is simple:

What is it worth to own it here? Snowmass Village: 2025 comparisons are shaped by Base Village development cycles

Snowmass Village year-over-year comparisons in 2025 are heavily affected by the closing cycle of major 2024 Base Village developments.

Snowmass Village YTD (through Nov 2025) – Residential

- Total Dollar sales: $449M vs $856M prior year (-48%)

- Total Unit sales: 92 vs 183 prior year (-50%)

Context: 2024 totals were elevated by Base Village projects Aura and Cirque x Viceroy (roughly 70 units). Many contracts were written earlier (often 2022) and closed in 2024 upon completion and issuance of certificates of occupancy.

Inventory (Nov 2025)

- 93 active listings vs 60 prior year (+55%)

Context: 2025 inventory is elevated due to Stratos (roughly 89 slopeside condos), listed January 2025; approximately 71 are under contract and 18 remain available.

Pricing (Sep–Nov, last 3 months)

- Single-family homes: median sale price $5.55M (vs $6.95M prior year); median $/sf flat ($1,950 vs $2,000)

- Condos: median sale price $2.2M (vs $3.89M prior year); median $/sf down ($2,177 vs $2,539)

Snowmass pricing remains highly dependent on product cohort (legacy inventory vs newer Base Village), which can shift median indicators materially from one period to the next.

_____

Should you have any questions and/or would like to discuss the market, listing your property or purchasing property, feel free to contact me 970-309-616 to discuss and for any questions. Please pass this on to family, friends and associates. Thank you.