By Joel Stonington

September 4, 2006

It’s no secret that Aspen’s real estate market is absurdly expensive, nor that it has experienced amazing growth in the last 30 years. Here’s another log to the fire: 2006 has already seen unprecedented appreciation

Condominiums are some of the easiest properties to track, and it’s where people have seen someof the biggest value increases.

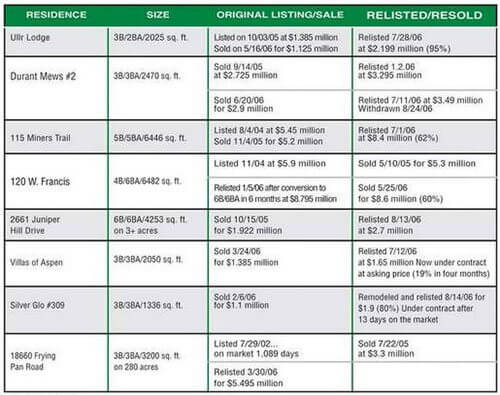

A Villas of Aspen unit, for example, recently saw a 19 percent increase in four months. It sold for $1.385 million in March, was relisted in July at $1.65 million and is now under contract.

"It’s easier to see when you’re looking at condominiums," said BJ Adams, owner of BJ Adams and Company Real Estate. "You can look at a complex like the Gant and see what’s happened over the last few years and it’s amazing. There aren’t any more Gants. People are thinking that if they don’t get in now then next year it probably wont be any better."

As Fyrwald puts it, people see a house or condo on the market and then it gets purchased by someone else before they can act. Waiting to buy in Aspen for much of its history has been a bad decision because the market can move upward so quickly. Tim Estin, a broker at Mason & Morse, calls it "should’a, would’a, could’a." That feeling feeds the market.

Increases of value have also been seen in examples of "flipping," whereby someone buys a house or condo, puts some money into renovation and sells it quickly at a net gain.

The house at 120 West Francis, a four-bedroom, 6-bath, 6,482-square-foot home was purchased for $5.3 million in May 2005, renovated to a six-bedroom and re-sold in January for $8.6 million. Likewise, a Silver Glo unit (3-bedroom, 3-bath) sold for $1.1 million in February and is now under contract after renovation for $1.9 million.

While the national market evens out, Aspen’s market remains on an upward trend. Part of that may be that great wealth is not as interest-rate sensitive.

"There can be a point where people aren’t willing to pay the number, but we haven’t seen it," Fyrwald said. "With limited inventory, just by the nature of its physical size, the number of people who want to be here and who can afford to be here will outstrip supply."

Estin, of Mason & Morse, believes the hot market can be attributed the perception that Aspen is a safe market. Aspen’s world class amenities, cultural and intellectual activities drive demand. Slow growth policies and restrictive zoning keep supply in check.

He also sees Aspen as one of the hottest towns in what has become known as the "third coast," areas where people not bound to a specific location are flocking towards.

However, real estate experts say the value increases in the market are certainly not across the board. And what may look like a sure bet for appreciation is not actually so simple. The market can be tricky, and much of the money that’s been driving it here is right up at the top.

"A number of really big sales are staggering," said Adams. "There’s a perception that the real estate community knocks off $20 million home sales every day. The truth is that there have been few of those sales in Aspen’s history."