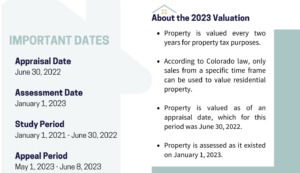

Your updated assessed property valuations were sent out May 1st by mail, and I’m here to help if you have any questions. Many of my clients have already seen that their assessed values are substantially higher than expected. Yes, it’s great to know you have built more equity in your home but the tradeoff is that your property tax bill may increase significantly as well – it depends on how local taxing districts re-assess their mill levies in the fall that will determine your actual property tax . If you’d like a professional opinion of value for your home, or discuss a possible protest to your updated valuation by the deadline June 8th, please get in touch before June 1st by cell/txt 970.309.6163 or email.

Recent news articles explaining Pitkin County property valuations, May 2023:

Property values soar and what it means for your Aspen Snowmass Pitkin County taxes, ADN 05/02/23

State & local restrictions will limit Pitkin County property taxes, AT 04/06/23

How to read your property valuation notices, AT opinion by Pitkin County Assessor 05/04/23

Tips for a successful protest from the Pitkin County Assessor

- Protesting your value is free and easy so here are some helpful tips of how to be successful in protesting your value:

- Review and submit comparable sales from within or nearby your neighborhood. See Comparable Sales at the Pitkin County Assessor website.

- Review these 2023 Successful Appeal Tips and Reminders.

- Write a summary of any information regarding your property that would ensure an accurate record of your property that we currently don’t have or that might need correcting.

- Submit an appraisal from the appropriate time frame, if you have one.

- If you have listed your property for sale or have any listing information such as a valid offer, that would be helpful. Sales after the time period will be used for the next reappraisal cycle and cannot be used for the basis of value.

- Residential properties use valid sales that occurred to determine a market value. Even if your property is not listed for sale, we must use market data to set values.

- Do not protest your taxes. The Assessor’s office only handles the value. The Treasurer handles the taxes and taxing entities set the tax amounts (in the form of mill levies, which the Assessor does not set).

- Zillow values are not a valid argument for our office. Those values are a computer-generated snapshot of the current time frame whereas our values are from past sales.

- Be sure to submit your information and protest on time. The dates to protest are May 1 – June 8, 2023