v 2.0 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-over-year (YoY)… Read More

This Section contains Estin Reports: Aspen Snowmass Real Estate Market Reports and Monthly Snapshots for the past 12 months. Prior year reports and monthly snapshots are archived in the Past Reports section.

The reports are:

1) Bi-Annual: State of the Aspen Snowmass Residential Real Estate Market Report: The most current and timely narrative and and scrubbed stats available.

2) Monthly Aspen Snowmass Residential Market Report Snapshots: Aspen Snowmass real estate summary (10 pages of detailed monthly stats and ‘bottom line’ commentary) released on or near the 1st Monday of each month. Includes sales stats by neighborhoods in 6-month periods that includes the subject month (Pgs 7 & 9).

3) Weekly Blog: Aspen Snowmass Weekly property closings and under contract activity is posted every Monday morning, sometimes in-between. Lots of photos, details and comments. At the bottom of the Blog Section are the Blog Archives by year from 2006.

4) Aspen Snowmass Real Estate Historic Pace of Sales Charts: updated every quarter showing Aspen and Snowmass Village residential dollar and unit real estate sales by area and property types (past 10 yrs) and trend lines.

Sotheby’s 2026 Luxury Outlook Report

The Sotheby’s International Realty® 2026 Luxury Outlook report is available here for download. This industry leading report delves into key trends shaping the luxury market including the priorities of today’s homebuyers, the growing interest in multigenerational living, security and privacy as essential features, and inventory levels and what they mean… Read More

Aspen Real Estate 2025: Ultra-luxury – Over $20M – is Now a Normalized Market Segment

This is a year-end 2025 snapshot of Aspen and Snowmass Village residential real estate prepared just after Christmas, 12/27/25. The full 32-page 2025 year-end Estin Report will follow in early-mid January. References herein are made to the November 2025 Market Snapshot. Nov 2025 Snapshot (Pg 4)… Read More

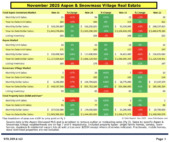

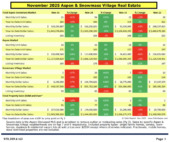

November 2025 Aspen Snowmass Real Estate Market Report Snapshot

v1.6 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-over-year (YoY)… Read More

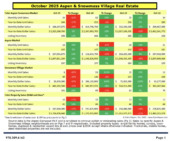

October 2025 Aspen Snowmass Real Estate Market Report Snapshot

v1.75 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-over-year (YoY)… Read More

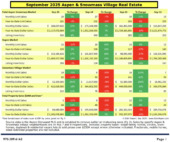

September 2025 Aspen Snowmass Real Estate Market Report Snapshot

v1.5 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-over-year (YoY)… Read More

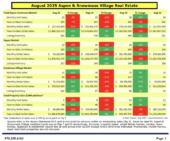

August 2025 Aspen Snowmass Real Estate Market Snapshot

v2.1 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-over-year (YoY)… Read More

July 2025 Aspen Snowmass Real Estate Market Snapshot

v2.1 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-over-year (YoY)… Read More

Estin Report: H1 2025 Mid-Year Aspen Snowmass Real Estate Market

The Estin Report: H1 2025 Aspen Snowmass Real Estate Market has just been posted for PDF download in my Current Reports Section. This is a 32-pg bi-annual report on the individual Aspen and Snowmass Village markets and combined. The print edition is available in racks around Aspen… Read More

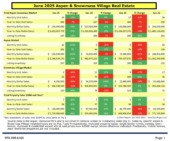

June 2025 Aspen Snowmass Real Estate Market Snapshot

v2.0 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-over-year (YoY)… Read More

May 2025 Aspen Snowmass Real Estate Market Snapshot

v2.1 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-over-year (YoY)… Read More

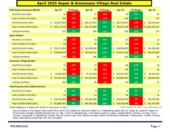

April 2025 Aspen Snowmass Real Estate Market Report

v2.1 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-over-year (YoY)… Read More